Online trading in India has become increasingly popular in recent decades, providing easy access to and investment in the stock market and other financial markets worldwide. However, with the convenience of online trading comes the risk of potential losses due to market volatility, trading errors, and technical difficulties. Therefore, Risk management has become essential in managing investments, reducing losses, and increasing profitability. This article will explore risk management strategies in online trading and ways to protect your assets.

Research, research, and research

The first step towards effective risk management in online trading is ensuring adequate research. Traders must conduct extensive research on the companies they are investing in, the economic indicators that may impact their investments, and the specific market trends of the relevant industry. By doing so, traders can make informed investment decisions and avoid high-risk investments that could potentially lead to significant losses.

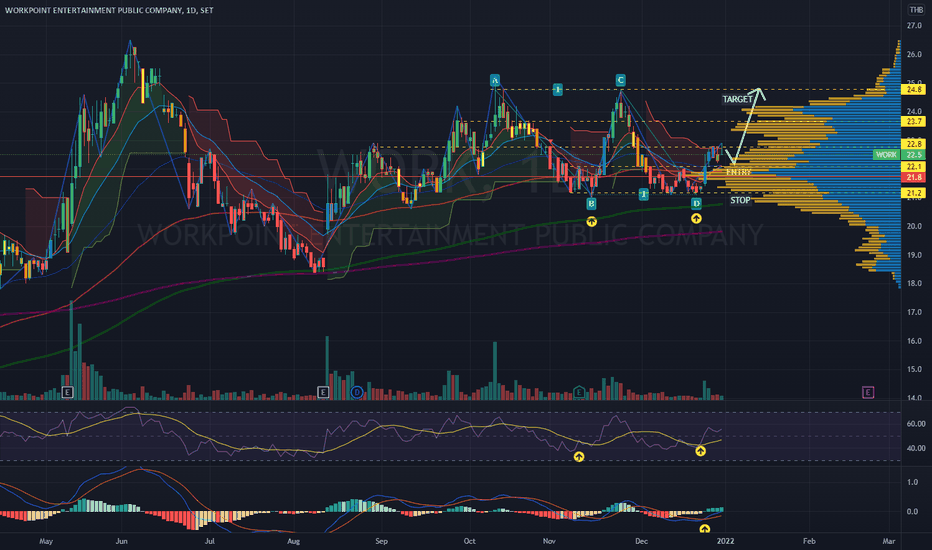

Implement stop-loss orders

The second step towards effective risk management in online trading India is the implementation of stop-loss orders. A stop-loss order is an instruction given to a broker to sell an asset when it reaches a specific price point to prevent further losses. Stop-loss orders are essential in mitigating potential loss due to market volatility or other unforeseen circumstances. It is important to note that stop-loss charges can also result in missed opportunities for gains due to selling too early in a positive market trend. Thus, traders must set up their stop-loss orders carefully and consider the potential risks and benefits of the strategy.

Avoid Trading errors

One of the most significant risks in online trading in India is trading errors, such as placing orders incorrectly or trading with the wrong investment amount. To manage this risk, traders must utilize the tools available, such as trading software with built-in risk management features such as automatic stop-loss orders, limit orders, and margin calls. These risk management features protect the trader’s investments and limit potential losses.

Go for smart diversification

The next risk management strategy in online trading is diversification. Diversification is spreading investments across different assets, companies, and industries to manage the risk of loss and enhance the potential for returns. By diversifying their portfolio, traders reduce the risk of significant losses in case of a particular company or sector’s decline. Market diversification is an investment strategy that requires careful consideration of market trends and company sectors to create a diversified portfolio suitable for the trader’s investment goals and risk management strategy.

Staying Informed

Risk management in online trading India platforms also entails staying informed and updated on global and market news, industry trends, and regulatory developments. By keeping up-to-date with these trends and changes, traders can make informed investment decisions and position themselves more favorably in the market. Market conditions and regulations are continuously changing. Thus it is crucial to stay informed of all regulatory changes and factors that impact the market’s performance. Stay knowledgeable to avoid significant losses due to poor investment decisions.

Understanding one’s risk tolerance is another essential component of risk management in online trading. Knowing the level of risk one can afford and comfortable taking is crucial before investing in any financial market. Traders must also set realistic investment goals and expectations based on risk tolerance and market analysis.